Algorithmic trading represents a significant shift in the financial world. With advanced algorithms and high-speed computing, traders and investors can execute trades with unparalleled speed and accuracy. This technological innovation has transformed financial market operations, moving away from manual trading methods to sophisticated automated systems. In this comprehensive guide, we’ll explore algorithmic trading in depth, examining its components, the role of candlestick patterns, the benefits of using MetaTrader, how algorithmic strategies work, the importance of paper trading, and the future prospects of this evolving field.

What is Algorithmic Trading?

Algorithmic trading, also known as algo trading, involves using computer algorithms to execute trading strategies automatically. These algorithms analyze market data, make trading decisions, and execute trades based on predefined criteria, without human intervention.

Key Components of Algorithmic Trading:

1. Algorithms: At the heart of algorithmic trading are complex algorithms that dictate the trading process. These algorithms use mathematical models to identify trading opportunities based on market data. They can be simple, like moving averages, or complex, involving multiple variables and conditions.

2. Execution Systems: Once the algorithm generates a trading signal, the execution system places the trade. This involves sending orders to the market, managing order size, and handling order execution.

3. Data Analysis: Algorithms require real-time data to make informed decisions. This data includes price quotes, volume, and other market metrics. High-frequency trading algorithms, for example, rely on tick-by-tick data to make split-second decisions.

4. Backtesting: Before deploying an algorithm in live trading, it is crucial to backtest it using historical data. This process helps to evaluate how the algorithm would have performed in the past and allows for optimization.

Advantages of Algorithmic Trading:

- Speed: Algorithms can process and execute trades in milliseconds, making them ideal for high-frequency trading where speed is crucial.

- Precision: Automated trading reduces human error by executing trades exactly as programmed.

- Consistency: Algorithms follow predefined rules, ensuring that trading strategies are applied consistently without emotional bias.

- Scalability: Algorithms can handle multiple trades and portfolios simultaneously, managing large volumes of trades that would be impractical for manual trading.

Candlestick Patterns in Algorithmic Trading

Candlestick patterns are integral to technical analysis and provide insights into market sentiment and price movements. In algorithmic trading, these patterns can be used to design algorithms that identify and act on specific market signals.

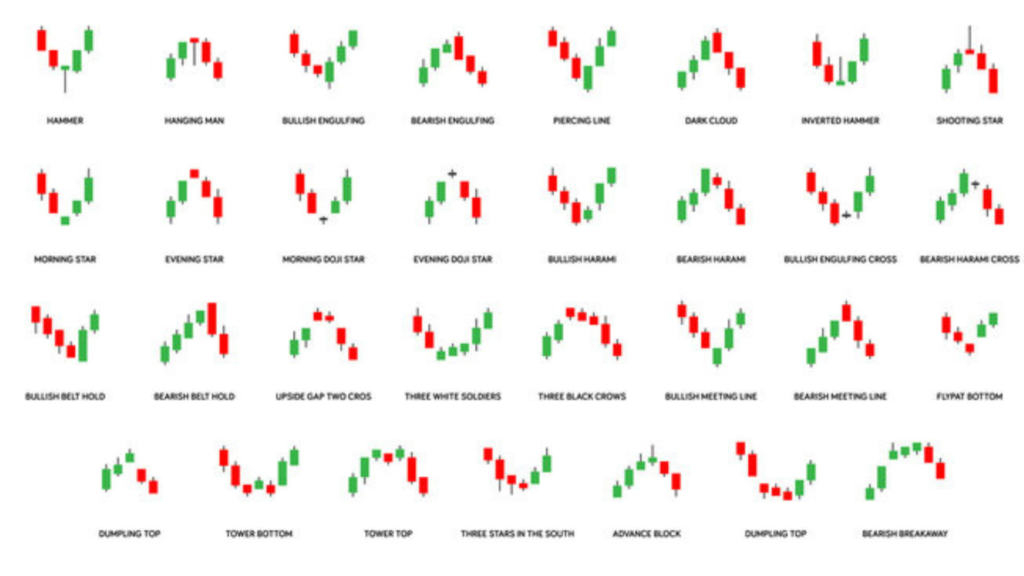

Common Candlestick Patterns:

1. Doji: A Doji candlestick has a small body and long wicks, indicating market indecision. Algorithms can be programmed to recognize this pattern and predict potential reversals or trend continuations.

2. Hammer: This pattern forms after a downtrend and suggests a potential bullish reversal. Algorithms can be set to buy when a Hammer pattern is detected, indicating increased buying pressure.

3. Engulfing Pattern: The Engulfing pattern occurs when a larger candlestick completely engulfs the previous one, signaling a potential reversal. Algorithms can use this pattern to generate buy or sell signals based on its appearance.

4. Head and Shoulders: This pattern signals a reversal of the current trend and is useful for predicting trend changes. Algorithms can detect this pattern to adjust trading strategies, such as closing long positions or initiating short trades.

Integrating Candlestick Patterns into Algorithms:

- Pattern Recognition: Algorithms can be designed to scan for specific candlestick patterns and generate trading signals based on their occurrence. This involves defining criteria for pattern recognition and incorporating it into the trading logic.

- Signal Filtering: To enhance accuracy, algorithms can use additional filters such as volume or trend indicators to confirm candlestick patterns and reduce false signals.

- Decision-Making: Algorithms use candlestick patterns as part of a broader trading strategy, combining them with other indicators and conditions to make well-informed trading decisions.

MetaTrader: A Tool for Algorithmic Trading

MetaTrader is one of the most popular trading platforms for algorithmic trading. It provides a comprehensive suite of tools for designing, testing, and deploying trading algorithms.

Features of MetaTrader:

1. Expert Advisors (EAs): Expert Advisors are automated trading systems that execute trades based on predefined rules. Traders can create custom EAs or use existing ones to automate their trading strategies.

2. Custom Indicators: MetaTrader allows traders to develop custom indicators, which can be used to enhance trading algorithms. These indicators can provide additional signals or refine existing strategies.

3. Backtesting: The platform’s backtesting functionality enables traders to test their algorithms on historical data, evaluating performance and optimizing strategies before live deployment.

4. Real-Time Data: MetaTrader provides real-time market data, including price quotes, order book data, and news updates. This is essential for the effective operation of trading algorithms, ensuring they respond to current market conditions.

Benefits of Using MetaTrader for Algorithmic Trading:

- User-Friendly Interface: MetaTrader’s interface is designed to be intuitive, making it easier for traders to create and manage trading algorithms.

Extensive Community Support: The platform has a large and active user community, providing access to a wealth of resources, including forums, tutorials, and shared algorithms.

- Comprehensive Tools: MetaTrader offers a range of tools for developing, testing, and deploying trading algorithms, making it a versatile platform for algo trading.

Trading with Algorithmic Strategies

Algorithmic trading strategies are designed to automate trading decisions and execution. These strategies can vary widely, from simple rules-based systems to complex algorithms using advanced techniques.

Popular Algorithmic Trading Strategies:

1. Trend Following This strategy involves identifying and following market trends. Algorithms analyze historical price data to detect trends and make trades that align with the prevailing direction. For example, a moving average crossover strategy can signal buying or selling opportunities based on trend changes.

2. Mean Reversion: Mean reversion strategies are based on the concept that prices will return to their historical average over time. Algorithms identify deviations from the mean and execute trades to profit from these reversion opportunities. For instance, if a stock’s price deviates significantly from its historical average, the algorithm might initiate a trade anticipating a return to the mean.

3. Arbitrage: Arbitrage strategies exploit price discrepancies between different markets or financial instruments. Algorithms execute trades to capitalize on these discrepancies and achieve risk-free profits. For example, if a stock is priced differently on two exchanges, an arbitrage algorithm would buy the stock at a lower price and sell it at a higher price.

4. Statistical Arbitrage: This strategy involves using statistical models to identify and exploit market inefficiencies. Algorithms analyze historical data to predict price movements and make trades based on statistical relationships between assets. For example, a pairs trading strategy might involve trading two correlated stocks when their price relationship deviates from the historical norm.

Implementing Algorithmic Strategies:

- Strategy Development: Traders develop algorithms by defining rules, conditions, and parameters based on their chosen strategy. This involves coding the logic into the algorithm and incorporating various technical indicators and data sources.

- Testing and Optimization: Algorithms are tested using historical data to evaluate their performance. Optimization techniques are applied to refine the algorithm, improving its accuracy and effectiveness. This may involve adjusting parameters, optimizing execution speed, and incorporating additional filters.

- Live Trading: Once an algorithm has been tested and optimized, it is deployed in a live trading environment. Continuous monitoring and adjustments are necessary to ensure the algorithm performs well under real market conditions. Traders may need to make updates based on changes in market dynamics or performance issues.

The Importance of Paper Trading in Algorithmic Trading

Paper trading, or simulated trading, allows traders to practice and refine their strategies without risking real money. It is a crucial step in developing and implementing algorithmic trading strategies.

Benefits of Paper Trading:

1.Strategy Testing: Paper trading provides a risk-free environment for testing algorithms and strategies. Traders can evaluate how their algorithms would have performed in real market conditions and make adjustments as needed.

2. Performance Evaluation: Traders can assess the performance of their algorithms by tracking key metrics such as profitability, risk, and trade execution. This helps identify strengths and weaknesses in the strategy.

3. Experience Building: Paper trading helps traders gain experience with algorithmic trading tools and platforms. It allows them to become familiar with the functionalities of platforms like MetaTrader and develop their skills.

4. Confidence Building: Successfully paper trading can build confidence in a trader’s algorithmic strategies. It ensures that the trader is prepared for live trading scenarios and can handle real market conditions effectively.

How to Utilize Paper Trading:

- Simulate Real Conditions: Paper trading should mimic real market conditions as closely as possible. This includes using real-time data, following market trends, and executing trades based on actual market scenarios

- Evaluate Performance Metrics: Track performance metrics such as return on investment (ROI), drawdown, and trade execution to assess the effectiveness of trading strategies.

- Refine Strategies: Use insights gained from paper trading to refine and improve algorithms. Adjust parameters, optimize execution, and incorporate additional filters based on performance analysis

The Future of Algorithmic Trading

The future of algorithmic trading is shaped by advancements in technology and evolving market dynamics. As technology continues to progress, algorithmic trading is expected to become more sophisticated, offering new opportunities and challenges for traders.

Emerging Trends:

1. Artificial Intelligence (AI) and Machine Learning: AI and machine learning technologies are set to revolutionize algorithmic trading. These technologies can analyze vast amounts of data, identify complex patterns, and improve the accuracy of trading predictions. AI-driven algorithms can adapt to changing market conditions and optimize trading strategies more effectively.

2. High-Frequency Trading (HFT): High-frequency trading involves executing a large number of trades at extremely high speeds. HFT algorithms capitalize on small price movements and rely on advanced technology to gain a competitive edge. As technology advances, HFT is likely to become even more prevalent in financial markets.

3. Blockchain Technology: Blockchain technology has the potential to enhance transparency and security in algorithmic trading. By providing a decentralized and tamper-proof record of trades, blockchain can reduce the risk of fraud and manipulation. It may also enable new forms of trading and settlement processes.

Challenges and Opportunities:

- Market Complexity: As markets become more complex, algorithms must adapt to new conditions and manage increasing volumes of data. Developing algorithms that can handle market complexity and volatility will be crucial for future success.

Regulatory Considerations: Regulatory frameworks for algorithmic trading are evolving, and traders must stay informed about compliance requirements. Ensuring that algorithms adhere to regulatory standards will be essential to avoid legal issues and maintain market integrity.

Technological Advancements: Keeping up with technological advancements is crucial for maintaining a competitive edge in algorithmic trading. Traders must continuously update their algorithms and tools to leverage the latest innovations and stay ahead of the curve.

Conclusion

Algorithmic trading is transforming the stock market by providing tools for high-speed, precise, and consistent trading. By integrating candlestick patterns, utilizing platforms like MetaTrader, and employing various trading strategies, traders can enhance their trading performance. Paper trading serves as a valuable tool for developing and refining algorithmic strategies, ensuring that traders are well-prepared for live trading.

As technology continues to advance, the future of algorithmic trading holds exciting possibilities. Emerging trends such as AI, machine learning, and blockchain are expected to shape the evolution of algorithmic trading, providing new opportunities and challenges for traders.

For those looking to explore algorithmic trading, staying informed about the latest developments and continuously refining strategies is essential. The Millionaires Group offers resources and support to help traders navigate this dynamic field and make the most of their trading endeavors.

FOR A FREE STOCK MARKET SEMINAR VISIT HERE

CALLS @ 9986622277

Disclaimer

The information I’ve included here is for general informational purposes only and should not be construed as financial advice. Investing in the stock market involves inherent risks, and profits or protection against losses are not guaranteed. Before making any investment decisions, conducting thorough research and seeking advice from a qualified financial advisor or professional is essential.