In the trading world, the Bullish Belt Hold is a term you might encounter. But what does it mean, and how can it help you succeed in trading? Don’t worry; we’re here to demystify it for you in the simplest terms possible. By the end of this guide, you’ll have a clear roadmap to navigate the exciting world of trading with confidence.

Introduction

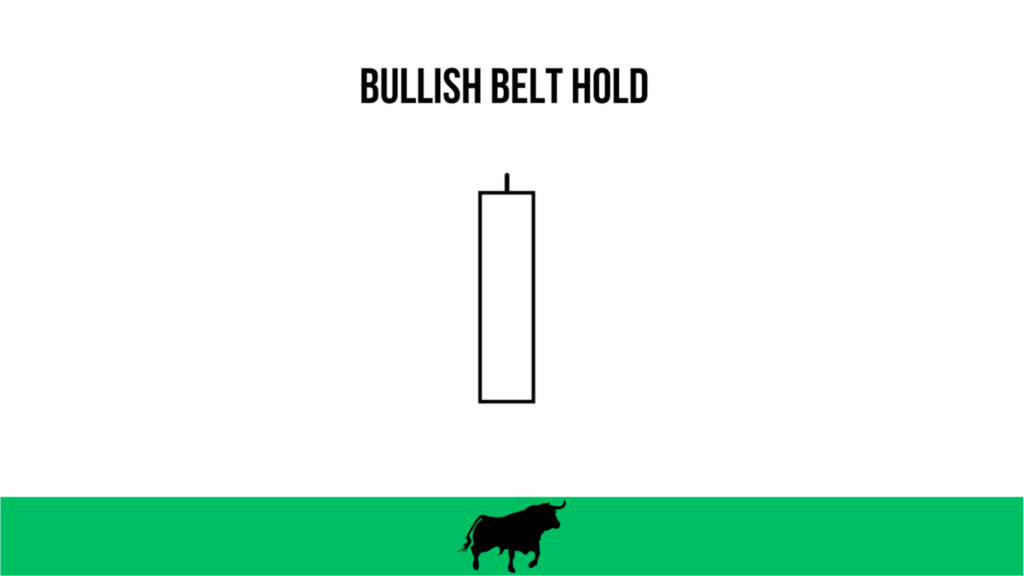

Before diving into the intricacies of the Bullish Belt Hold, let’s break down the term. In trading, ‘bullish’ signifies optimism and upward momentum, while ‘belt hold’ refers to a single candlestick pattern on a price chart.

What is a Bullish Belt Hold?

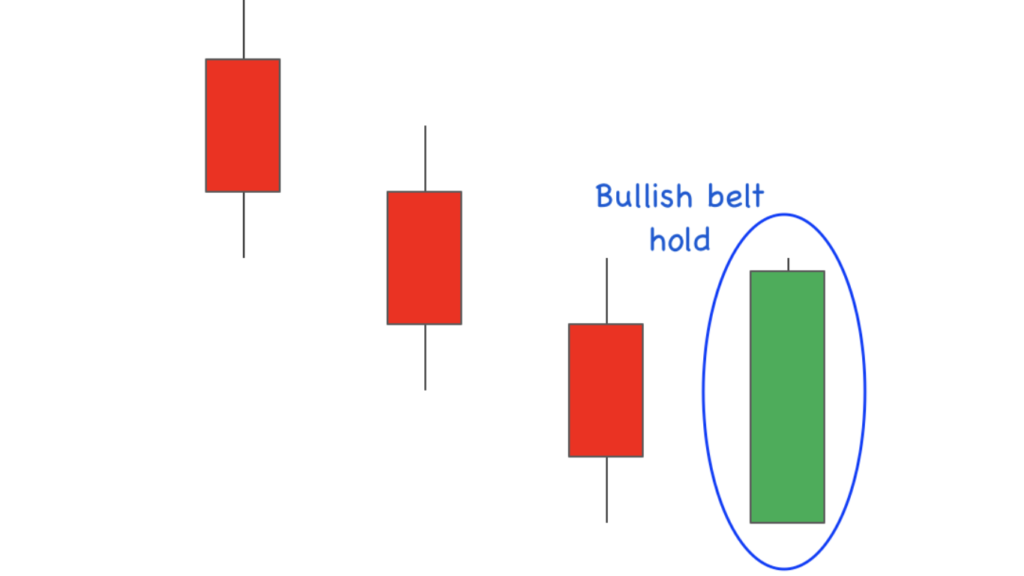

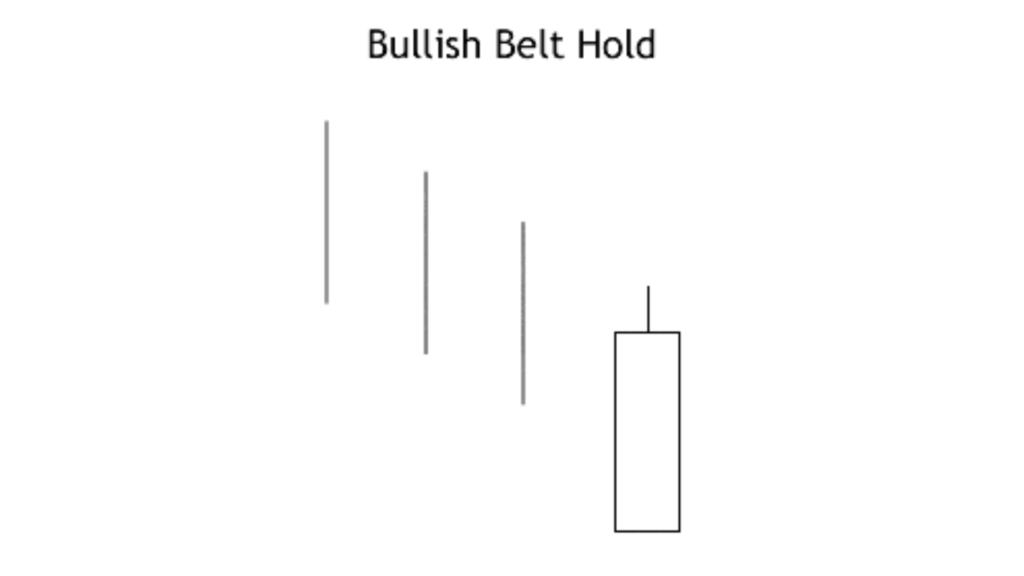

Imagine a rocket launching into the sky. The Bullish Belt Hold is akin to when the rocket gains momentum, soaring higher and higher. It’s a bullish candlestick pattern that indicates a potential reversal from a downtrend to an uptrend.

How to Identify a Bullish Belt Hold?

Spotting a Bullish Belt Hold is like recognizing a beacon of hope amidst darkness. Look for a long bullish candlestick that opens near the low of the day and closes near the high, with little to no upper shadow and a small lower shadow. This pattern typically appears after a downtrend and signals a shift in market sentiment from bearish to bullish.

The Psychology Behind Of It

Understanding the psychology behind the Bullish Belt Hold is crucial for effective trading decisions.

Market Sentiment: From Fear to Optimism

Picture a crowd at a sports game. Initially, they’re quiet and tense, fearing their team might lose. Suddenly, a spectacular play ignites hope, and the atmosphere transforms into jubilant cheers. Similarly, the Bullish Belt Hold reflects a shift in market sentiment from fear and uncertainty to optimism and confidence.

Buying Pressure: Bulls Taking Control

Visualize a tug-of-war between two teams. One team, representing the Bears, has been dominating for a while. Suddenly, the other team, the bulls, gather their strength and start pulling the rope in their direction. The Bullish Belt Hold symbolizes this moment when buying pressure overwhelms selling pressure, causing prices to surge upwards.

How to Trade Using It

Now that you understand the basics let’s explore how to leverage the Bullish Belt Hold to enhance your trading strategy.

Entry Points: Seizing Opportunities

Identifying entry points is crucial in trading. The Bullish Belt Hold presents an excellent opportunity to enter trades at the beginning of an uptrend. Traders often look for confirmation signals, such as higher volume or additional bullish patterns, to validate their entry decisions.

Stop Loss Placement: Mitigating Risks

Just as a seatbelt protects you in a car, a stop-loss order safeguards your trading capital. Placing a stop-loss below the low of the Bullish Belt Hold candlestick can help limit potential losses if the trade doesn’t go as planned.

Conclusion

In conclusion, the Bullish Belt Hold is not just a technical term; it’s a powerful tool that can guide your trading journey toward success. By understanding its significance, recognizing its patterns, and incorporating it into your strategy, you can navigate the markets with confidence and optimism.

FOR A FREE STOCK MARKET SEMINAR VISIT HERE

CALLS @ 9986622277

Disclaimer

The information provided here is for general informational purposes only and should not be construed as financial advice. Investing in the stock market involves inherent risks, and there is no guarantee of profits or protection against losses. Before making any investment decisions, it is essential to conduct thorough research and seek advice from a qualified financial advisor or professional.