CHART PATTERN

A Chart Pattern Is A Basic Example Of The Specialized Technical Analysis Of A Fund/ Asset. Be That As It May, They Need Some Getting Acquainted With It Before They Could Be Adequately Utilized. For Assisting You With Taking A Few To Get Back Some Composure Of Them, There Are Some Chart Patterns Every Trader Should Know.

Chart Pattern Is The Shape Inside The Chart Of Value Which Helps In Proposing The Costs That May Do Next Based On What They Have Done Already. The Chart Pattern Is The Premise Of The Specialized Investigation And Requests That The Trader Understand What He Is Taking A Gander At And What He Is Searching For.

There Is No Example For The Best Chart Patterns As They Are Utilized For Featuring The Various Chart Patterns In The Wide Scope Of Business Sectors. Regularly, The Chart Pattern Design Is Utilized In The Candle Chart Trade Which Makes It Simple To See Past Opens Just As Shut On The Lookout.

Some Portion Of The Examples Are Undeniably More Reasonable To The Unpredictable Market While Some Are Most Certainly Not. Some Portion Of The Examples Are Most Appropriate In The Bullish Market And Some Are Best Reasonable When The Market Is In The Bear Structure.

Having Said That, It’s Vital To Comprehend The Way That The Example Of The “Best” Chart For A Specific Market Using Some Unacceptable One Or Understanding Which One Ought To Be Utilized May Create You Miss The Open Door To Acquire Benefit.

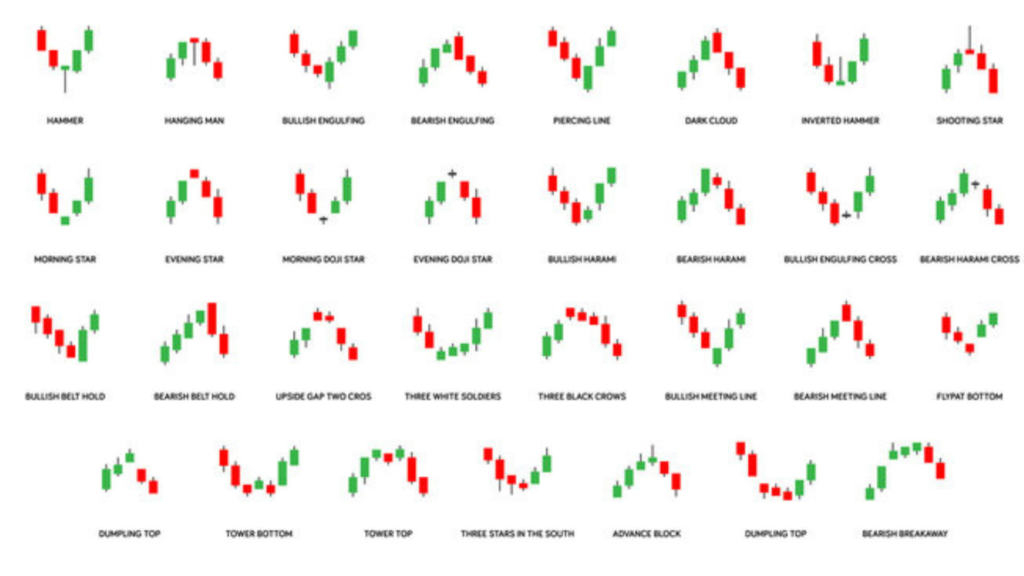

Candlestick Pattern

In The Monetary Specialized Examination, A Candle Design Is A Development In Costs Shown Graphically On A Candle Outline That Some Accept Can Foresee A Specific Market Development. The Acknowledgment Of The Example Is Abstract And Projects Utilized For Outlining The Need To Depend On Predefined Rules To Coordinate The Example. 42 Perceived Examples Can Be Part Into Straightforward And Complex Examples.

The Candle Outline Is A Specialized Device That Packs The Information For Various Periods In A Single Value Bar. It Makes Them Undeniably More Helpful When Contrasted With The Customary Open High, Close Low Bars Or The Basic Lines Which Associate All The Dots Of The End Cost. The Examples Of The Candle Predict The Bearing Of The Cost Once Done. Appropriate Coding Of Shading Adds A Great Deal Of Profundity To The Vivid Device Which Has A Place With The Eighteenth-Century Rice Merchants Of Japan.

It Is Genuine This Candle Design Shows About 40% Exactness, However, The Creators Like To Be Wary About 60% Unpredicted Market Conduct. Most Financial Backers (Investors) In The Capital Market Essentially Realize That There Are Two Sorts Of Examinations Ordinarily Utilized Before They Choose Which Stock Will Produce More Capital Addition Later On.

The Following Are The Candlestick Patterns That Perform Well As The Antecedent Of Value Force Or Course. Every One Of The Works Inside The Encompassing Valuing Bars For Foreseeing Lower Or Greater Costs. They Are Even Delicate To Time 2ly:

They Simply Work Inside Impediments Of Diagrams Being Evaluated

Their Intensity Decreases Quickly 3 To 5 Bars After The Pattern Has Been Finished.

Unwavering quality of the candle design for the financial backers (investors).

Not all candlestick patterns function admirably. Their fame has low dependability as they have been analyzed by the hedge funds just as their calculations. The all-around subsidized names rely upon the quick speed to trade/exchange when contrasted with the conventional financing chiefs and retail financial backers/investors who execute the procedures of specialized investigation found in the famous writings.

In straightforward words, the speculative stock investment supervisors utilize programming to catch the members looking for high chances of bearish or bullish results. Nonetheless, the dependable examples seem to give present moment and long haul chances of benefit to the traders.

FOR A FREE STOCK MARKET SEMINAR VISIT HERE

CALLS @ 9986622277

Disclaimer

The information provided here is for general informational purposes only and should not be construed as financial advice. Investing in the stock market involves inherent risks, and there is no guarantee of profits or protection against losses. Before making any investment decisions, it is essential to conduct thorough research and seek advice from a qualified financial advisor or professional.