In the dynamic world of trading, price gaps are significant events on a price chart where a notable difference exists between the closing price of one trading session and the opening price of the next. Gaps can reveal a lot about market sentiment and price action, offering valuable insights for traders. Understanding the different types of gaps and how to respond to them can greatly enhance your trading strategy.

What is a Price Gap?

A gap is a space on a price chart where no trading occurs. This absence of trading creates a visible gap between the closing price of one period and the opening price of the next. Gaps can appear on various timeframes, from minutes in intraday trading to days or weeks in longer-term trading. They reflect significant changes in supply and demand dynamics and can be influenced by various factors, including news events, earnings reports, or economic data releases.

Why Are Gaps Filled?

Gaps often get filled over time due to several reasons:

- Market Sentiment Adjustments: Gaps can result from sudden changes in market sentiment. As traders reassess the value of a stock or asset based on new information, they might push the price back towards the gap area, leading to a gap fill.

Technical Corrections: Gaps might represent an overreaction or underreaction to news or events. As the initial excitement or panic subsides, the price tends to correct itself and move back toward the level where the gap occurred.

Supply and Demand Dynamics: When a gap forms, it can create an imbalance in supply and demand. As the price approaches the gap area, buying or selling pressure may increase, causing the price to fill the gap.

Types of Price Gaps

Understanding the different types of gaps can help you interpret their implications for price movement. Here’s a detailed look at the various types:

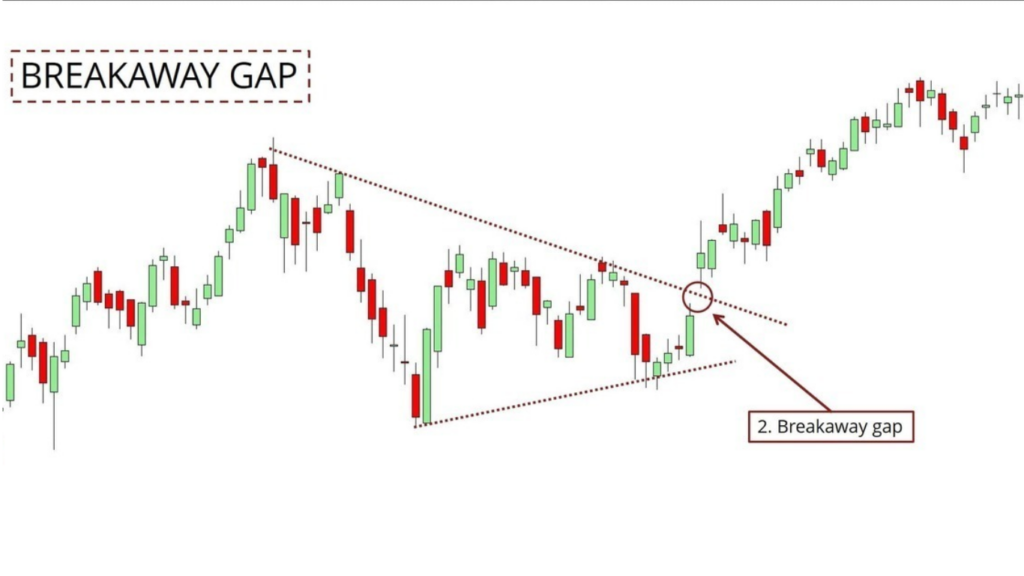

1. Breakaway Gap

- Definition: A breakaway gap occurs when the price breaks out from a consolidation pattern, such as a rectangle or triangle, and signals the beginning of a new trend. This type of gap marks a significant shift in market dynamics.

Key Characteristics:Volume:

Volume: High trading volume often accompanies a breakaway gap, indicating strong conviction in the new trend.

Trend Initiation: The gap represents a decisive move away from previous price levels, suggesting the start of a new trend.

Example: If a stock has been trading within a range and suddenly gaps up above resistance, this breakaway gap signals the start of a potential uptrend.

Trading Strategy: Enter the market in the direction of the gap, with the expectation that the new trend will continue. Confirm the gap’s significance with increased volume and momentum indicators.

2. Exhaustion Gap

- Definition: An exhaustion gap appears near the end of a strong trend and suggests that the trend is losing momentum and may reverse. It often signifies the final surge in price before a potential reversal.

- Key Characteristics:

Volume: Volume may decrease compared to the preceding trend, indicating that the buying or selling pressure is diminishing.

Trend Reversal: The gap often precedes a reversal pattern, where the price changes direction after the gap.

Example: In a prolonged uptrend, an exhaustion gap occurs when the price surges significantly, only to reverse and start a downtrend.

Trading Strategy: Be cautious and look for reversal signals after an exhaustion gap. Consider closing long positions or preparing for a potential short entry.

3. Continuation Gap

- Definition: A continuation gap occurs during a trend and indicates that the trend is likely to continue. This type of gap happens when the price breaks through key support or resistance levels during a strong trend.

- Key Characteristics:

Trend Continuation: The gap signifies that the existing trend is gaining momentum and is expected to continue.

Volume: Typically accompanied by increased volume, reinforcing the strength of the ongoing trend.

Example: In a strong uptrend, a continuation gap forms when the price moves higher and remains above previous resistance levels, suggesting further gains.

Trading Strategy: Enter trades in the direction of the trend, using the gap as confirmation of trend strength. Set targets based on trend projections and technical indicators.

4. Common Gap

- Definition: A common gap is a frequent occurrence in price charts, often seen in range-bound markets or as part of regular market fluctuations. These gaps are generally less significant and may not indicate strong market movements.

Key Characteristics:

Frequency: Common gaps occur frequently and are typically filled quickly.

Lack of Impact: They usually do not signal strong trends or reversals and are often just a part of normal market activity.Example: A stock trading within a tight range might have a common gap that fills quickly as the price continues to oscillate within the range.

Trading Strategy: Focus on other technical indicators and chart patterns rather than common gaps for trading decisions. Use these gaps as minor signals within a broader range-bound strategy.

5. Runaway Gap

- Definition: A runaway gap, also known as a continuation gap, appears in the middle of a strong trend and indicates that the trend is likely to persist. This gap often signifies robust momentum in the direction of the trend.

- Key Characteristics:

Momentum: The gap indicates strong momentum and confirms that the trend is likely to continue.

Volume: Increased volume often accompanies a runaway gap, reflecting strong trader interest.

Example: In a bullish trend, a runaway gap might occur when the price jumps significantly, reflecting sustained buying pressure.

Trading Strategy: Enter trades in the direction of the trend, using the runaway gap as confirmation of trend strength. Monitor for potential trend exhaustion signs.

6. Island Gap

- Definition: An island gap forms when there is a gap in one direction, followed by a period of consolidation, and then another gap in the opposite direction. This creates an “island” of price action that can signal a potential reversal.

- Key Characteristics:

Reversal Signal: The island gap often indicates a potential reversal or a significant change in market sentiment.

Consolidation: The gap is usually preceded and followed by periods of consolidation, creating a distinct price island.

Example: A stock might gap up, trade sideways, and then gap down, forming an island pattern that suggests a trend reversal.

Trading Strategy: Look for reversal signals and consider trading in the direction opposite the island gap. Confirm the reversal with additional technical indicators.

7. Trending Gap

- Definition: A trending gap occurs during a strong trend and indicates that the trend is continuing with high momentum. It often appears in volatile market conditions.

- Key Characteristics: Strong Momentum: The gap reinforces the strength of the existing trend, indicating continued momentum.

Volatility: Trending gaps often occur during periods of high volatility, reflecting strong market movement.

Example: In a strong uptrend, a trending gap might occur when the price makes a significant move higher, reflecting ongoing bullish sentiment.

Trading Strategy: Use the trending gap as confirmation to enter or hold positions in the direction of the trend. Monitor for potential signs of trend reversal.

What Should You Do with a Price Gap?

When encountering a gap, consider the following actions to enhance your trading strategy:

1. Analyze the Gap Type: Identify the type of gap—whether it’s a breakaway, continuation, exhaustion, or common gap. Understanding the gap type helps interpret its implications for price movement.

2. Assess Market Conditions: Evaluate the overall market trend and sentiment. Gaps in trending markets often provide actionable insights, while gaps in range-bound markets may require different strategies.

3. Set Entry and Exit Points: Determine clear entry and exit points based on the gap type and market conditions. For example, a breakaway gap may offer an entry point at the gap level with a target based on the new trend.

4. Consider Volume: Volume is a crucial factor in validating the significance of a gap. High volume confirms the gap’s importance, while low volume may suggest it is less significant.

5. Risk Management: Implement risk management strategies, such as stop-loss orders, to protect yourself from adverse price movements. Gaps can sometimes lead to unexpected volatility, so having a risk management plan is essential.

Playing with the Gaps

When trading gaps, consider these strategies to maximize your potential:

1. Gap and Go: If you identify a breakaway or runaway gap, you might use a “gap and go” strategy by entering a trade in the direction of the gap. This strategy works well in strong trending markets and can capitalize on the momentum.

2. Fade the Gap: For common gaps or those occurring in range-bound markets, you might use a “fade the gap” strategy, trading against the direction of the gap with the expectation that the gap will be filled.

3. Gap Fill Strategy: Monitor gaps that occur within consolidation periods and use a gap-fill strategy to trade towards the previous level of the gap. This approach is effective in markets where gaps are frequently filled.

4. Use Indicators: Complement your gap analysis with technical indicators such as moving averages, RSI, or MACD to validate your trading decisions and enhance your strategy.

Conclusion

Understanding and identifying different types of price gaps, including the breakaway gap, exhaustion gap, continuation gap, common gap, runaway gap, island gap, and trending gap, is crucial for making informed trading decisions. By analyzing the gap type, assessing market conditions, and implementing effective strategies, you can navigate the complexities of trading gaps and improve your trading performance.

Happy Learning!

FOR A FREE STOCK MARKET SEMINAR VISIT HERE

CALLS @ 9986622277

Disclaimer

The information provided here is for general informational purposes only and should not be construed as financial advice. Investing in the stock market involves inherent risks, and there is no guarantee of profits or protection against losses. Before making any investment decisions, it is essential to conduct thorough research and seek advice from a qualified financial advisor or professional.