In the vast landscape of financial markets, understanding the basic concepts of trends is crucial for anyone looking to navigate the complexities of investments in India. Whether you’re a novice or an experienced investor, grasping the fundamentals can make a significant difference in making informed decisions. Let’s break down some key concepts that form the backbone analysis of trends in India.

Three Directions of Trend:

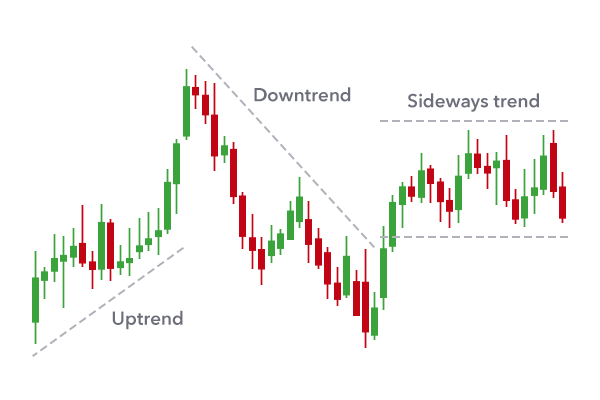

Trends in the Indian market can move in three primary directions: uptrend, downtrend, and sideways (or horizontal) trend.

Uptrend -:

A series of higher highs and higher lows characterize an uptrend. In simpler terms, the market is on the rise. Investors often find opportunities to buy during an uptrend, aiming to benefit from future price increases.

Downtrend -:

Conversely, a downtrend is marked by lower highs and lower lows, indicating a declining market. During a downtrend, investors may consider selling or shorting positions to capitalize on potential further declines.

Sideways Trend -:

In a sideways trend, prices move within a horizontal range, creating a trading range. This means there is no clear upward or downward direction. Traders may wait for a breakout from this range before making significant investment decisions.

Three Trend Lengths:

Trends can also be classified based on their duration: short-term, medium-term, and long-term.

Short-term Trend -:

This trend typically spans a few days to a few weeks and is influenced by short-term factors such as market news, economic reports, or company-specific events.

Medium-term Trend -:

The medium-term trend extends over several weeks to a few months. It is often influenced by a combination of short-term events and broader market dynamics.

Long-term Trend -:

Long-term trends unfold over several months to years, reflecting the overall health of the economy, major policy changes, and global economic conditions. Long-term trends are crucial for investors planning for extended periods.

Trend Lines:

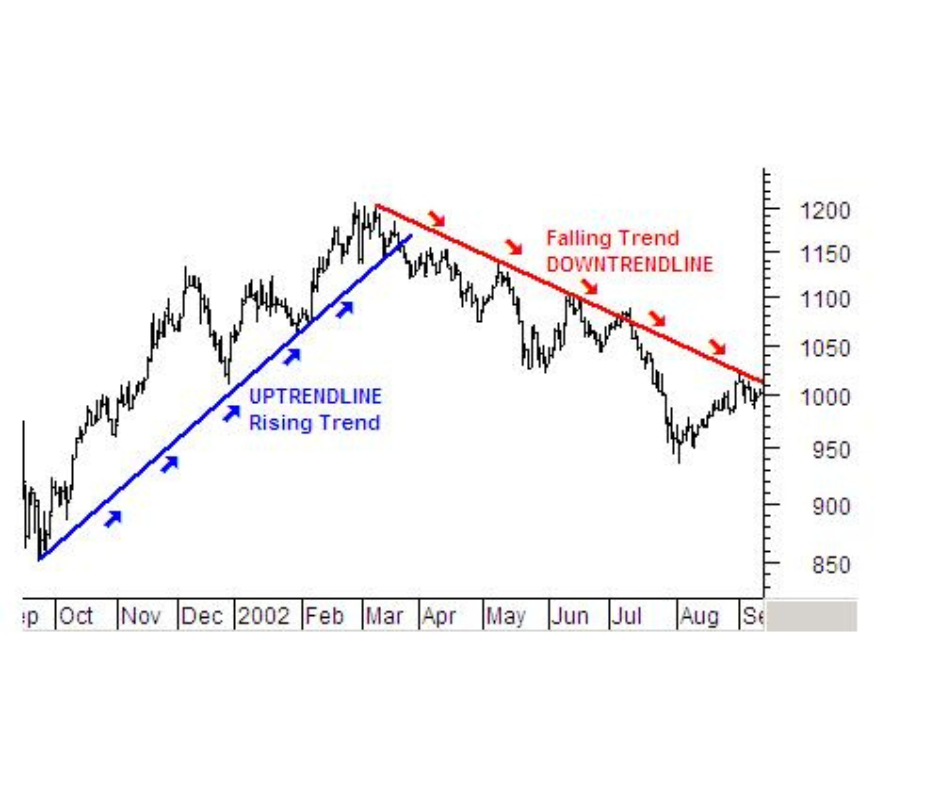

Trend lines are an essential tool in trend analysis. They help investors visualize the direction and strength of a trend. There are two main types of trend lines: uptrend lines and downtrend lines.

Uptrend Line -:

An uptrend line is drawn by connecting the lows in an upward-sloping trend. It acts as a support level, indicating that as long as prices remain above the line, the uptrend is intact. Investors may consider buying opportunities when prices approach the uptrend line.

Downtrend Line -:

Conversely, a downtrend line is drawn by connecting the highs in a downward-sloping trend. It acts as a resistance level, signaling that as long as prices stay below the line, the downtrend is likely to continue. Investors may consider selling or shorting positions when prices approach the downtrend line.

Conclusion:

Understanding the basics of trend analysis is a key step in navigating the Indian market. By identifying the direction and length of trends, and using trend lines to gauge potential entry or exit points, investors can make more informed decisions. Whether you’re a day trader, swing trader, or a long-term investor, incorporating these concepts into your strategy can enhance your ability to capitalize on market movements. Remember, staying informed and

FOR A FREE STOCK MARKET SEMINAR VISIT HERE

CALLS @ 9986622277

Disclaimer

The information provided here is for general informational purposes only and should not be construed as financial advice. Investing in the stock market involves inherent risks, and there is no guarantee of profits or protection against losses. Before making any investment decisions, it is essential to conduct thorough research and seek advice from a qualified financial advisor or professional.