Introduction

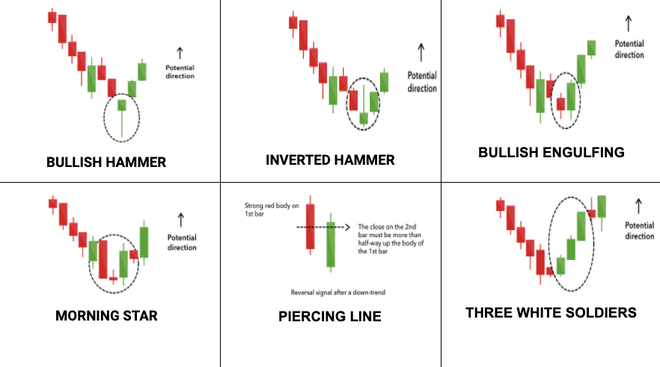

In the world of trading, mastering the art of identifying and leveraging candlestick patterns is crucial for success. Among the many patterns, the Morning and Evening Star candlestick patterns stand out for their reliability and potential to signal significant market reversals. Understanding these patterns and how to trade them effectively can greatly enhance a trader’s profitability and confidence in the market.

What are Candlestick Patterns?

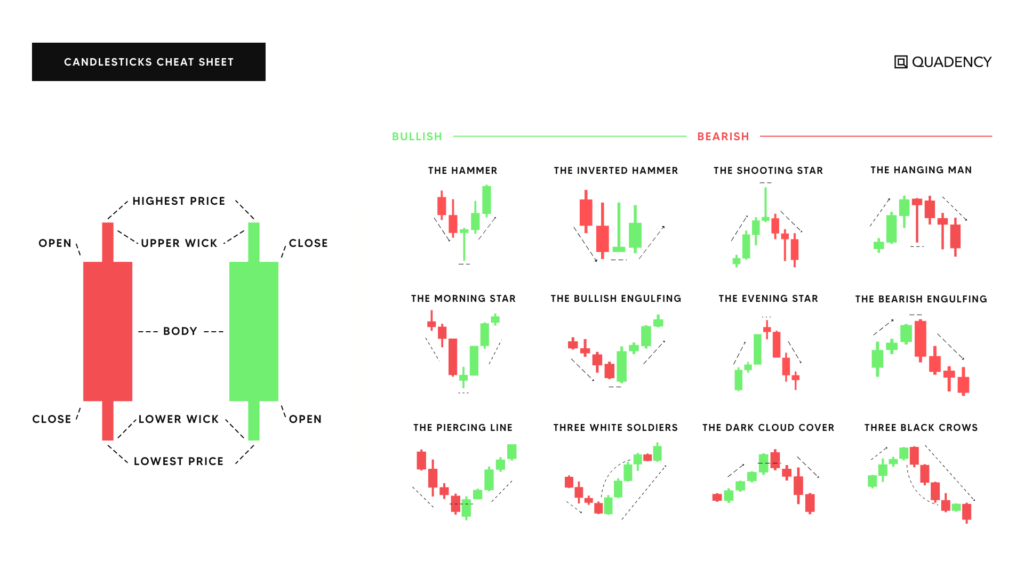

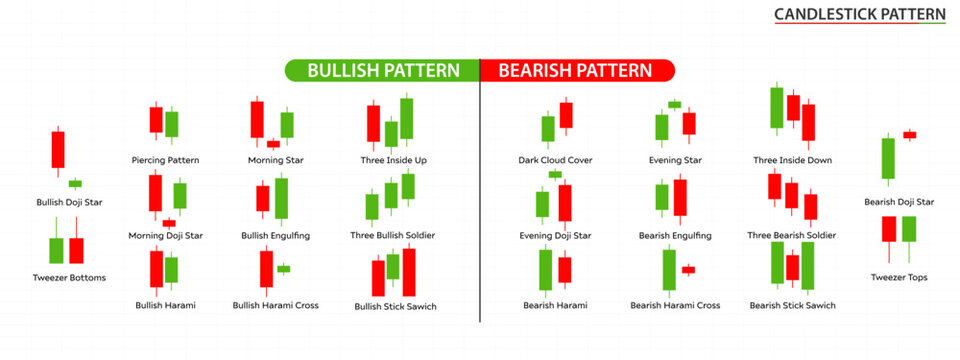

Before diving into the specifics of the Morning and Evening Star patterns, it’s essential to grasp the basics of candlestick patterns. Candlestick charts display the price movements of an asset over a specific period, typically depicting open, high, low, and close prices for each time interval. Candlestick patterns are visual representations of price movements that help traders identify potential market trends and reversals.

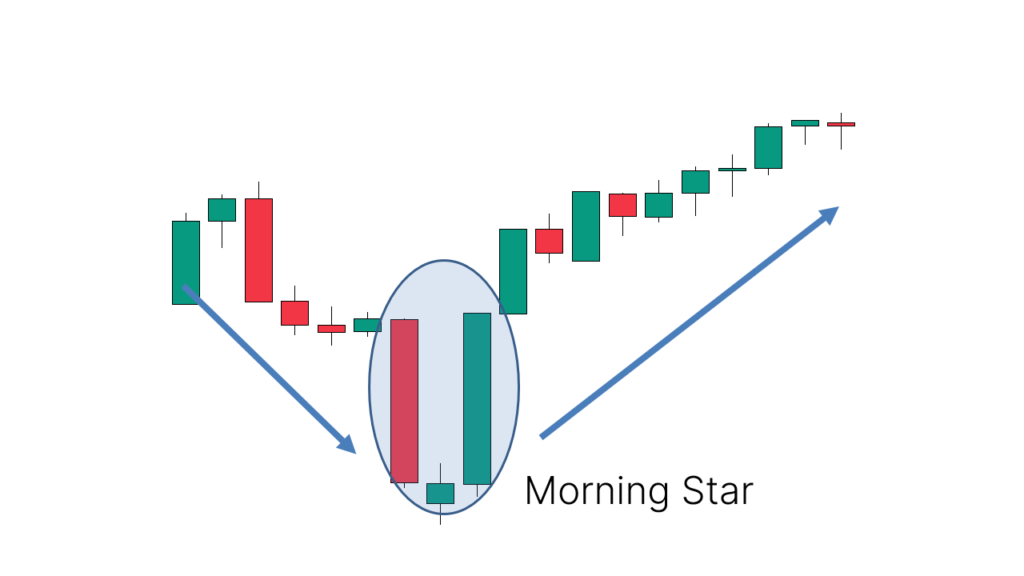

Understanding the Morning Star Pattern

The Morning Star pattern is a bullish reversal pattern that typically forms at the bottom of a downtrend, signaling a potential shift toward an upward trend. This pattern consists of three candles:

Bearish Candle: The first candle is long, indicating strong selling pressure.

Doji or Small Candle: The second candle is small-bodied, preferably a doji, signaling indecision in the market.

Bullish Candle: The third candle is a bullish candle that closes above the midpoint of the first candle, indicating a potential bullish reversal.

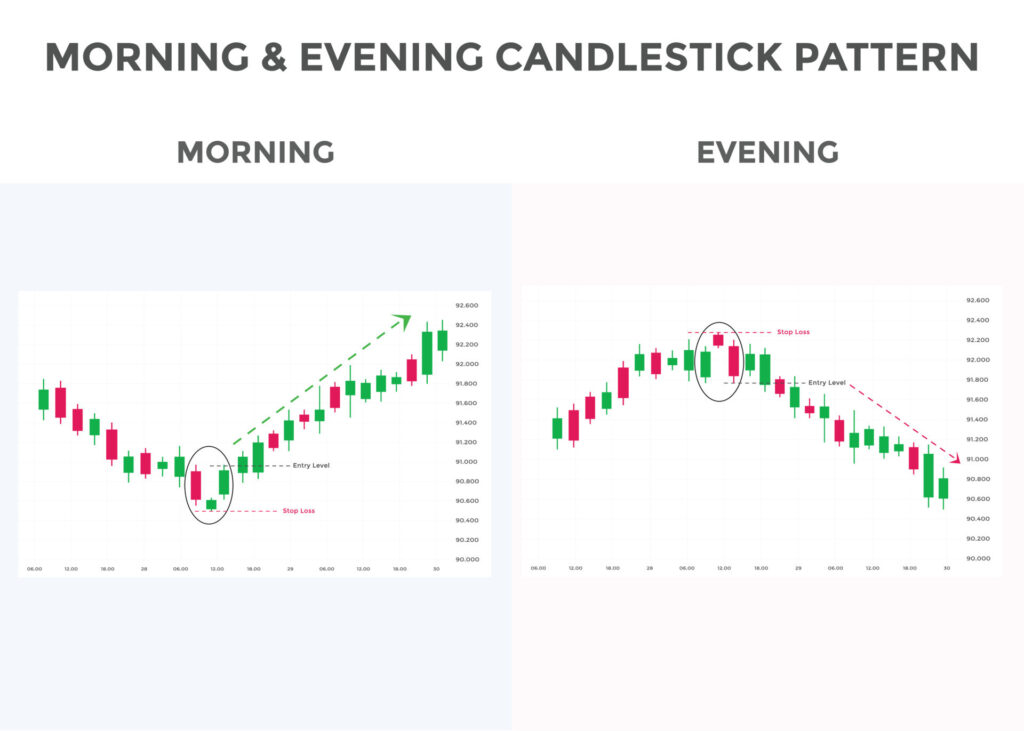

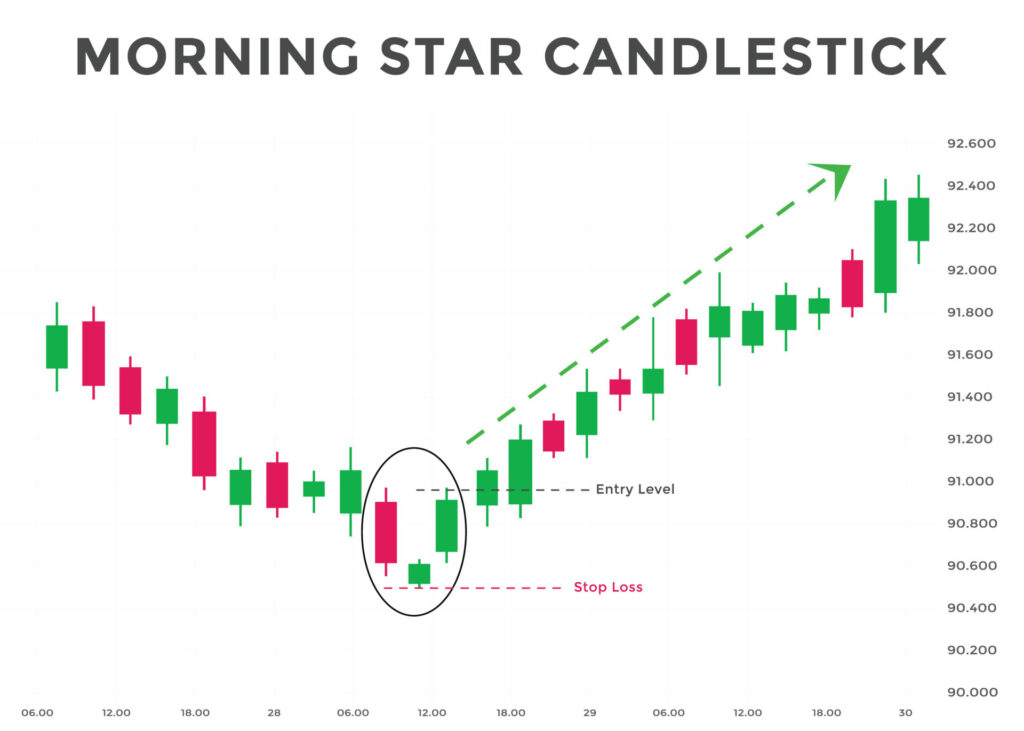

Trading the Morning Star Pattern

Trading the Morning Star pattern requires patience and confirmation to ensure its validity. Here’s a step-by-step guide:

Step 1: Identify the Pattern

Scan the charts for a downtrend followed by the formation of the three-candle pattern described above.

Step 2: Confirm the Pattern

Wait for confirmation in the form of a bullish candle closing above the midpoint of the first candle.

Step 3: Enter a Long Position

Once confirmed, consider entering a long position, either at the close of the confirmation candle or at the beginning of the next trading session.

Step 4: Set Stop Loss and Take Profit Levels

Implement risk management strategies by setting stop-loss orders below the low of the pattern and take-profit targets based on technical analysis or predefined risk-reward ratios.

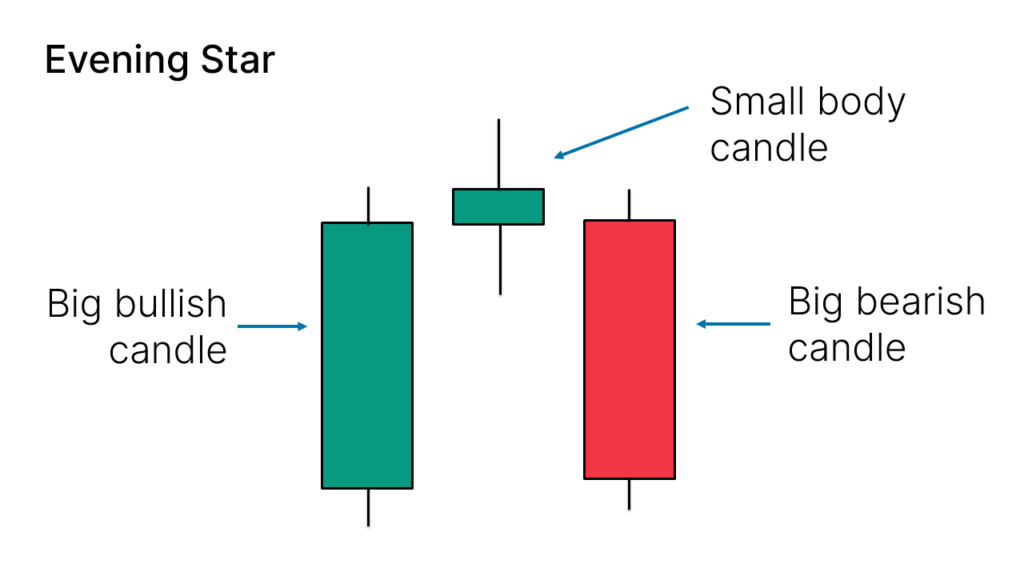

Exploring the Evening Star Pattern

Contrary to the Morning Star pattern, the Evening Star pattern is a bearish reversal pattern that typically forms at the peak of an uptrend, signaling a potential shift towards a downward trend. This pattern also consists of three candles:

Bullish Candle: The first candle is a long bullish candle, indicating strong buying pressure.

Doji or Small Candle: Similar to the Morning Star pattern, the second candle is small-bodied, signaling indecision.

Bearish Candle: The third candle is a bearish candle that closes below the midpoint of the first candle, indicating a potential bearish reversal.

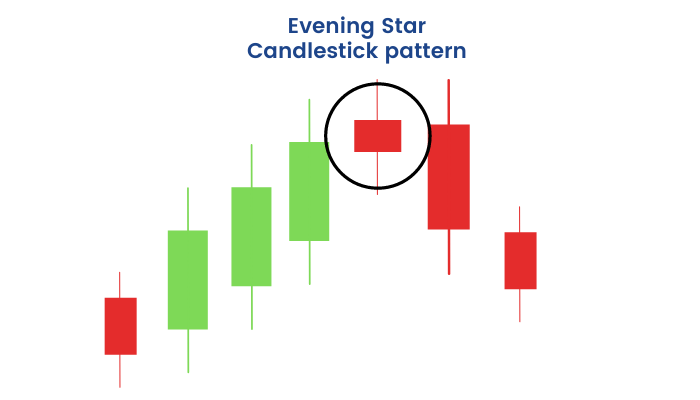

Trading the Evening Star Pattern

Trading the Evening Star pattern follows a similar approach to the Morning Star pattern but in the opposite direction. Here’s how to trade it effectively:

Step 1: Spot the Pattern

Identify an uptrend followed by the formation of the three-candle Evening Star pattern.

Step 2: Confirm the Reversal

Wait for confirmation with a bearish candle closing below the midpoint of the first candle.

Step 3: Initiate a Short Position

Consider entering a short position after confirmation, either at the close of the confirmation candle or at the beginning of the next trading session.

Step 4: Manage Risk and Reward

Implement stop-loss orders above the pattern’s high and set appropriate take-profit targets based on risk management principles.

Conclusion

Mastering the art of trading the Morning and Evening Star candlestick patterns can significantly enhance a trader’s ability to identify potential trend reversals and capitalize on profitable opportunities in the market. By understanding the structure of these patterns and following a disciplined approach to trading, investors can improve their overall trading performance and achieve greater success in their endeavors.

FAQs

Are Morning and Evening Star patterns reliable indicators of market reversals?

Yes, when properly identified and confirmed, these patterns can serve as reliable signals of potential trend reversals.

How can traders confirm the validity of these patterns?

Traders can confirm the validity of Morning and Evening Star patterns by waiting for confirmation candles that align with the pattern criteria.

What timeframes are suitable for trading these patterns?

Morning and Evening Star patterns can be identified on various timeframes, but they tend to be more reliable on higher timeframes such as the daily or weekly charts.

Do these patterns work across different financial markets?

Yes, Morning and Evening Star patterns can be applied to various financial markets, including stocks, forex, and commodities.

FOR A FREE STOCK MARKET SEMINAR VISIT HERE

CALLS @ 9986622277

Disclaimer

The information provided here is for general informational purposes only and should not be construed as financial advice. Investing in the stock market involves inherent risks, and there is no guarantee of profits or protection against losses. Before making any investment decisions, it is essential to conduct thorough research and seek advice from a qualified financial advisor or professional.