Swing trading is one of the popular trading strategies whereby traders intend to capture the short to medium-term gains in a stock or, for that matter, any financial instrument, over some days to weeks. It lies between day trading and long-term investment, providing a balanced approach that appeals to many beginners.

We will break down swing trading in simple terms, explore some effective strategies for swing trading, identify characteristics of good swing trade stocks, and explain how moving averages can help traders make informed decisions. By the end of the blog, you will have enough knowledge and a good base to begin your swing trading journey.

What is Swing Trading?

It is aimed at profiting from price swings that occur in the market. These price swings may last for some days or even weeks. As opposed to a day trader who has to square off his position before the close of the market, the swing trader holds a position longer in an attempt to gain profits from intermediate price movements.

Characteristics of Swing Trading:

Time Frame: Swing trades normally last from a few days to a few weeks.

Flexibility: The trader has the opportunity to benefit from both increasing and decreasing markets, by going long and selling short.

Technical Analysis: Swing traders mainly make use of charts and technical indicators for guidance.

Why Swing Trading?

It is a balanced trading approach with many benefits. It is:

Less Stressful: Unlike day trading, which requires constant monitoring, in swing trading, one can trade in a cool manner.

Better Return Potential: This strategy can potentially realize better returns than day trading by capturing greater price movements over several days or even weeks.

Flexibility: Swing trading can be done part-time, making it suitable for people with full-time jobs or other commitments.

It involves identification and following the market trend. The idea is to buy when the price is in an uptrend and sell when it’s in a downtrend.

How to Apply This Strategy:

Identify the Trend: Observe moving averages for the trend direction. For example, if the 50-day moving average is above that of the 200-day moving average, then it shows an uptrend.

Enter the Trade: Buy on a pullback to support in an uptrend; sell on a rally to resistance in a downtrend.

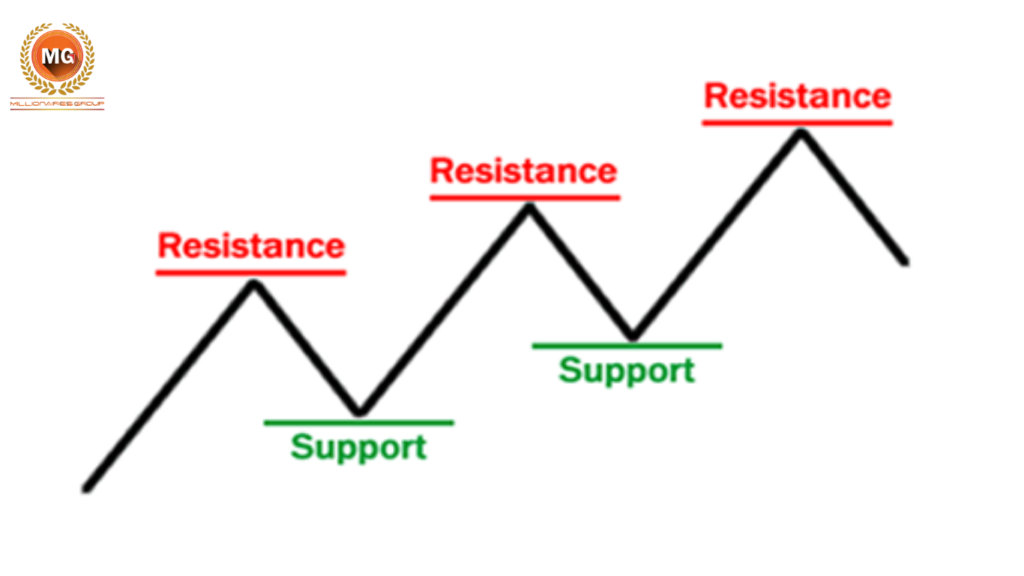

2. Support and Resistance Strategy

This plan is designed to buy at support levels and sell at resistance levels. Support is the level where the stock normally experiences buying interest, while resistance is where selling pressure is most likely to occur.

How to Use This Strategy:

Establish Support and Resistance Levels: Past price levels by which the stock turns around.

Entering the Trade: Buy on an approach to a support level. Sell on an approach to a resistance level.

3. Breakout Strategy

The breakout strategy is where you enter the trade when the price breaks out of a key level of support or resistance. The breakout can often mark the beginning of a new trend.

How to Use This Strategy:

Identify Breakout Levels: Identify key levels of support and resistance.

Enter the Trade: Buy when the price breaks above resistance with high volume. Sell when the price breaks below support with high volume.

4. Moving Average Crossover Strategy

This strategy makes use of moving averages so that it can provide a probable buy or sell signal. The usual approach in this respect is applying two moving averages: one shorter-term, and one longer-term moving average.

How to Use This Strategy:

Select Moving Averages: This could include a 50-day moving average and a 200-day moving average.

Establish the Trade: Sell when the short-term moving average breaks below the long-term moving average, and buy when it breaks above.

Selecting Good Swing Trade Stocks

Not all stocks are appropriate for swing trading. Some characteristics of good swing trade stocks:

1. High Liquidity

Liquidity is the extent to which an equity can be bought or sold without its price being significantly driven up or down. Highly liquid stocks have wide and narrow bid-ask spreads, which result in fewer possibilities of slippages while entering and exiting trades.

2. Volatility

Volatility is the degree of variation in a stock’s price over some time. The higher the volatility, the greater the price swings, hence the more opportunities for swing traders.

3. Clear Trends

Prefer those that tend to move in clear and consistent trends. Such a stock’s patterns are then more predictable and, hence easier to trade in.

4. Strong Fundamentals

Though swing trading is largely based on technical analysis, the fundamentals of the stock should not be ignored either. Companies with strong earnings, good management, and a positive outlook will not see their stock prices fall sharply.

Using Moving Averages in Swing Trading

Moving averages are one of the most popular technical indicators applied in swing trading, which helps smoothen out price data to enable the identification of trends and probable reversal points.

Types of Moving Averages:

Simple Moving Average (SMA): This is just the average price of the stock over a given time frame. For instance, a 50-day SMA shows the average closing price over the last 50 days of the respective security’s performance.

Exponential Moving Average (EMA): EMA gives more importance to the prices of the security that are more recent compared to older prices, which makes it more sensitive to new information than the simple moving average.

How to Use Moving Averages:

Identify the Trend: In case the price of a stock prevails above the moving average, an uptrend is indicated. Conversely, if the price prevails below it, then it indicates a downtrend.

Support and Resistance: The moving averages can act like dynamic support and resistance. During an uptrend, the moving average may act like a support level, while during a downtrend, it may act like a resistance level.

Crossovers: Moving average crossovers can indicate potential buy or sell signals. As described above, a crossover of the short-term MA above the long-term MA is a golden cross buy signal, while a death cross, wherein the short-term MA crosses below the long-term MA, is a sell signal.

Managing Risks in Swing Trading

Risk management forms the basis of long-term success in swing trading. The following are some guidelines on how to manage risk effectively:

1. Stop-Loss Orders

A stop-loss order is an instruction for the selling of a stock when it reaches a particular price. This helps in minimizing losses if things don’t go your way in a trade.

2. Position Sizing

Position sizing refers to how much capital should be put at risk in each trade. The general rule of thumb in this respect is not to risk more than 1-2% of your trading capital on any single trade.

3. Diversify Your Trades

Diversification means investing in a few stocks or sectors to minimize the risk associated with a particular stock. This way, if one of your stocks turns out poorly, then it will not affect your portfolio as a whole that much.

4. Monitor Your Trades

Keep a close eye on your trades and make changes in your strategy whenever necessary. Always keep a trading journal and see where you are going wrong.

Swing Trading Tools and Resources

To start swing trading, you need a few basic tools and resources. These are:

1. Trading Platform

Pick a reliable trading platform, with real-time data and charting tools that come with low commissions.

2. Technical Analysis Tools

Invest in technical analysis tools, especially those that give access to charts, indicators, and drawing tools. Such tools are essential in trend identification and decision-making.

3. Educational Resources

Get access to online courses, books, and forums to learn more about swing trading. One should always continue learning if he wants to enhance his trading skills.

4. News and Analysis

Stay informed about news and analysis. This is quite critical since economic events, earnings reports, and geopolitical developments can be key price movers for stocks.

Swing Trading Plan Development

The trading plan presents an overview of your trading strategy, risk management rules, and goals. The following steps give a lead on how to develop a swing trading plan:

1. Define Your Goals

Set realistic goals for trading: how much capital you want to put up, how much you can earn, and your tolerance level.

2. Choose Your Strategy

Choose a swing trading strategy that best suits your trading style and preference, like trend following, support and resistance, breakouts, or moving average crossovers.

3. Create Entry and Exit Criteria

Clearly define your entry and exit criteria into the trades, which would clearly show the conditions under which one will buy or sell a stock.

4. Risk Management Rules

Point out your risk management rules in the plan, by showing the stop-loss levels, the position sizing, and the diversification strategies.

5. Review and Adjust

Go through your trading plan frequently and rebalance where necessary. The market is dynamic, but your plan should be flexible enough to adjust to the changing conditions.

Conclusion

It means providing a balanced trading approach that will suit beginners and veteran traders. If you know the basics of swing trading, research various strategies, recognize good swing trade stocks, and use tools effectively like moving averages, you’ll increase your chances of success. Always remember that on a successful swing trading journey, two elements are applied: proper risk management and continuous learning.

With dedication, practice, and a very good trading plan in your hands, you can swing your way toward the financial goals in swing trading. Happy trading!

To learn more about expert swing trading strategies and tools, visit our service page.

FOR A FREE STOCK MARKET SEMINAR VISIT HERE

CALLS @ 9986622277

Disclaimer

The information provided here is for general informational purposes only and should not be construed as financial advice. Investing in the stock market involves inherent risks, and there is no guarantee of profits or protection against losses. Before making any investment decisions, it is essential to conduct thorough research and seek advice from a qualified financial advisor or professional.