Welcome to the attractive world of trading! If you’re new to the scene, you might feel overwhelmed by the abundance of information out there. But fear not! Today, we’re going to delve into a topic that might just become your new best friend in the trading world: the High Wave Candlestick Pattern. Sounds interesting, doesn’t it? Well, let’s break it down into simple, digestible bits so you can grasp it with ease.

Unveiling the Mystery: What is the High Wave Candlestick Pattern?

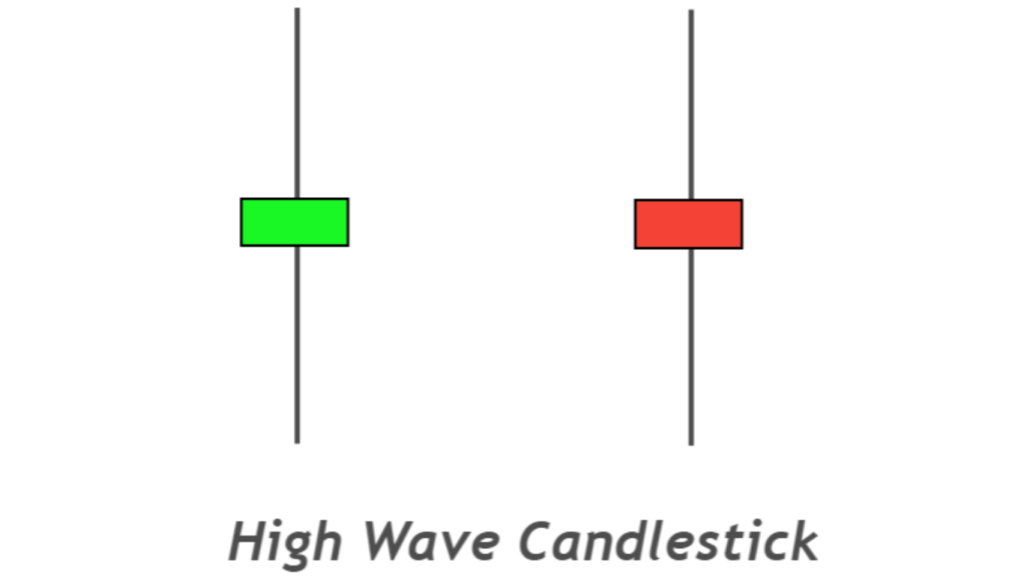

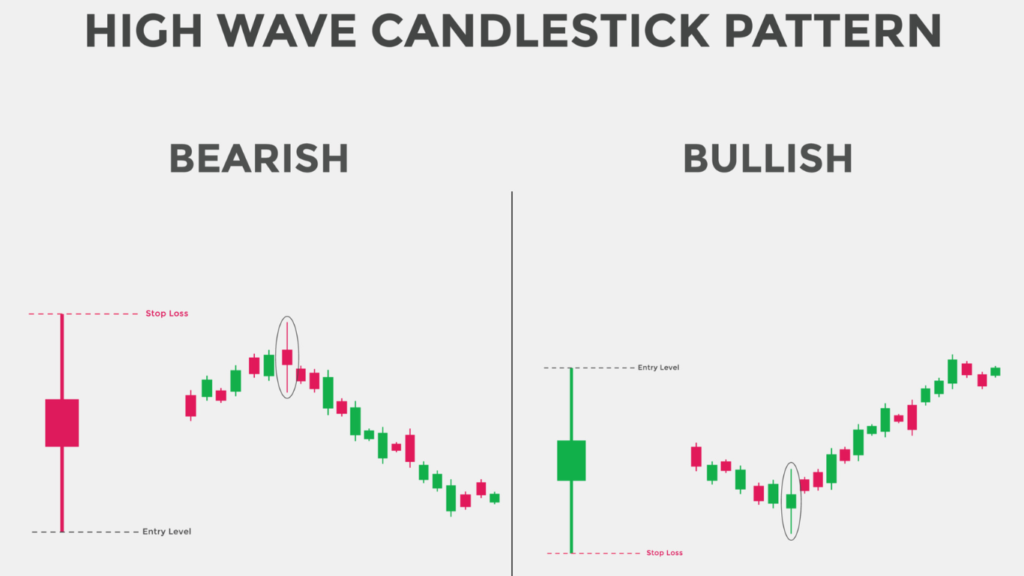

Before we dive headfirst into the complications, let’s start with the basics. Picture this: you’re looking at a candlestick chart, and amidst the various patterns, you spot one that stands out like a beacon in the night—the High Wave Candlestick Pattern. This pattern is characterized by long upper and lower shadows, indicating high volatility in the market. Essentially, it represents a battle between buyers and sellers, resulting in indecision and uncertainty.

Decode the Anatomy of the High Wave Candlestick

Now that we’ve identified our subject, let’s dissect it further. Imagine the candlestick as a tiny soldier standing tall on the battlefield of the market. The body of the candlestick represents the opening and closing prices, while the shadows or wicks depict the highest and lowest prices reached during the trading period. In the case of the High Wave Candlestick, these shadows are particularly long, signaling intense fluctuations in price.

Understanding the Psychology Behind the Pattern

Every pattern in trading has a story to tell, and the High Wave Candlestick is no exception. Think of it as a window into the minds of traders. When you see a High Wave Candlestick forming, it’s like witnessing a tug-of-war between bulls and bears. Neither side is willing to concede, resulting in a stalemate. This indecision often precedes significant market movements, making it a valuable tool for traders.

Unveiling the Mystery: What is the High Wave Candlestick Pattern?

Before we dive headfirst into the complications, let’s start with the basics. Picture this: you’re looking at a candlestick chart, and amidst the various patterns, you spot one that stands out like a beacon in the night—the High Wave Candlestick Pattern. This pattern is characterized by long upper and lower shadows, indicating high volatility in the market. Essentially, it represents a battle between buyers and sellers, resulting in indecision and uncertainty.

Spotting High Wave Candlesticks in the Wild

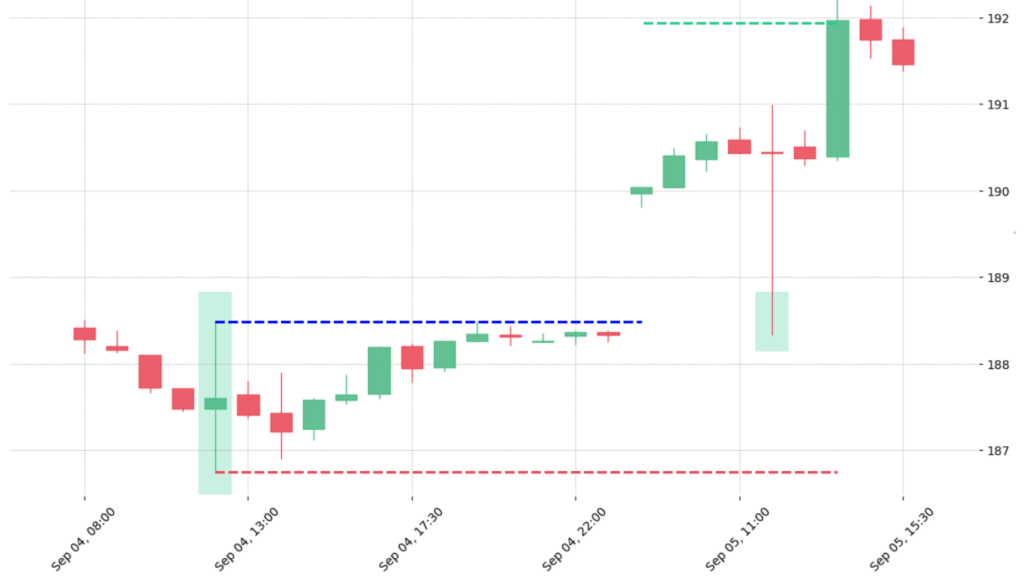

Now that we’ve grasped the essence of the High Wave Candlestick, let’s talk about spotting it in real time. Imagine you’re on a safari, scanning the horizon for exotic animals. Similarly, in the world of trading, you’re scanning charts for unique patterns. Look for candlesticks with long shadows and small bodies, resembling the shape of a high wave crashing against the shore. Once you train your eyes to recognize this pattern, you’ll feel like a seasoned explorer navigating through the wilderness of the market.

The Significance of Volume in High Wave Candlestick Analysis

In our quest to master the art of trading, we mustn’t overlook the role of volume. Volume acts as a magnifying glass, amplifying the significance of patterns like the High Wave Candlestick. When accompanied by high trading volume, the pattern becomes even more powerful, signaling a potential shift in market sentiment. So, keep an eye on the volume bars—they might hold the key to unlocking profitable opportunities.

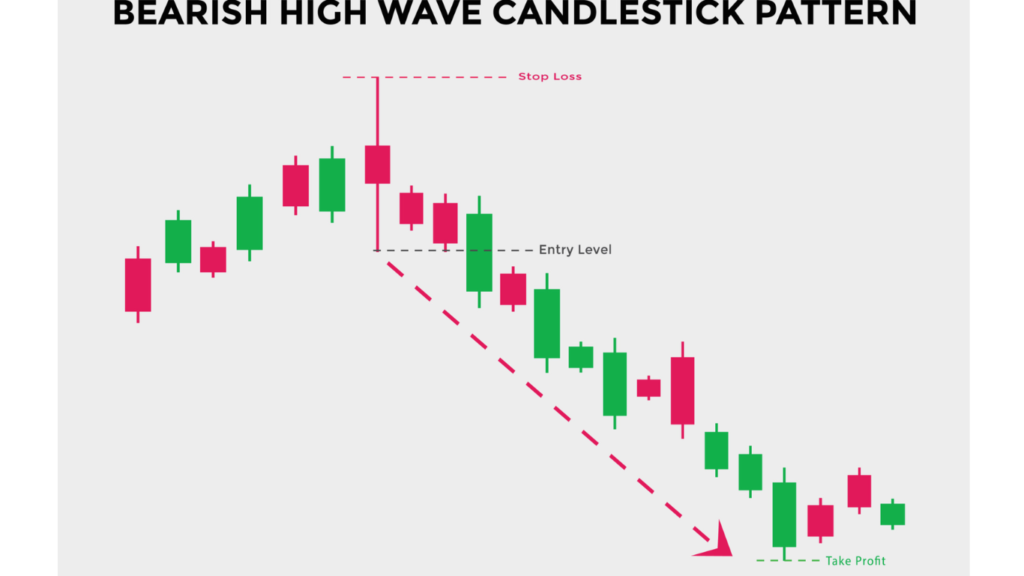

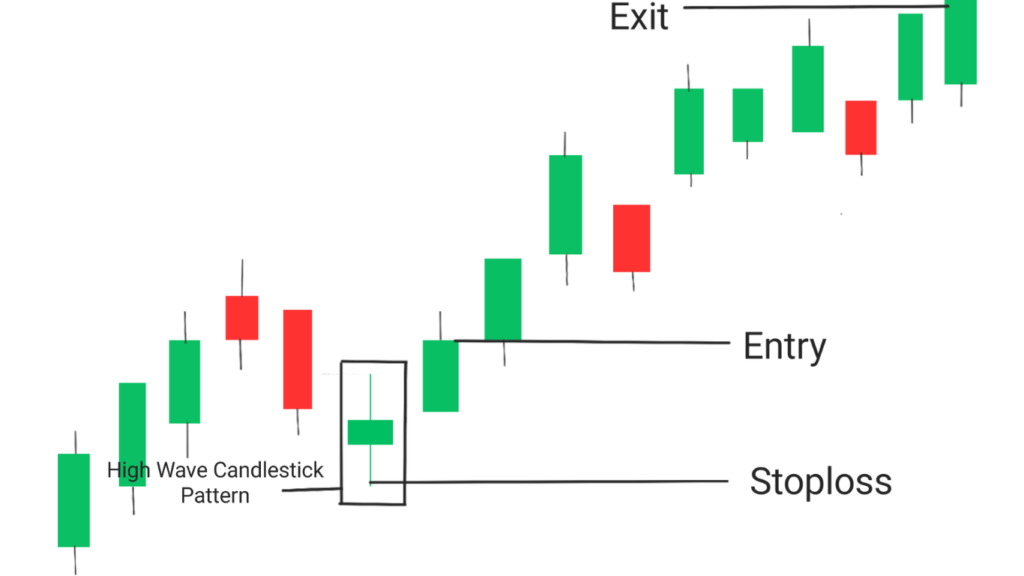

Practical Application: How to Trade the High Wave Candlestick Pattern

Now that we’ve laid the groundwork, let’s talk strategy. Trading the High Wave Candlestick requires a combination of patience and precision. Some traders prefer to wait for confirmation in the form of a subsequent candlestick confirming the pattern, while others dive in headfirst, placing their bets based on the potential reversal signaled by the pattern. Whichever approach you choose, remember to set stop-loss orders to mitigate risks and protect your capital.

Common Mistakes to Avoid When Trading High Wave Candlesticks

As with any trading strategy, there are pitfalls to watch out for. One common mistake is jumping the gun and entering a trade prematurely, only to realize later that the market had different plans. Another mistake is ignoring the broader market context and trading the pattern in isolation. Remember, context is key in trading—always consider the bigger picture before making decisions.

Fine-Tuning Your Trading Skills: Practice Makes Perfect

Like any skill worth mastering, trading requires practice and perseverance. Start by familiarizing yourself with historical charts, identifying High Wave Candlestick patterns, and analyzing their outcomes. As you gain confidence, gradually transition to live trading, start small, and gradually increase your position sizes as you hone your skills. And remember, even seasoned traders encounter setbacks—what matters is how you bounce back from them.

Conclusion: Riding the Waves of Success

Congratulations, you’ve made it to the end of our journey through the High Wave Candlestick pattern! Armed with this newfound knowledge, you’re better equipped to navigate the turbulent waters of the market. Remember, trading is not about predicting the future—it’s about managing risk and seizing opportunities when they arise. So, embrace the waves, learn from your experiences, and may your journey be filled with success and prosperity.

FOR A FREE STOCK MARKET SEMINAR VISIT HERE

CALLS @ 9986622277

Disclaimer

The information provided here is for general informational purposes only and should not be construed as financial advice. Investing in the stock market involves inherent risks, and there is no guarantee of profits or protection against losses. Before making any investment decisions, it is essential to conduct thorough research and seek advice from a qualified financial advisor or professional.